The Paul B Insurance Medigap Statements

Wiki Article

How Paul B Insurance Medigap can Save You Time, Stress, and Money.

Table of ContentsThe Paul B Insurance Medigap IdeasThe smart Trick of Paul B Insurance Medigap That Nobody is Talking AboutAll About Paul B Insurance MedigapLittle Known Facts About Paul B Insurance Medigap.Facts About Paul B Insurance Medigap Revealed

Eye health ends up being more crucial as we age. Eye tests, glasses, and get in touches with are a part of many Medicare Advantage strategies. Original Medicare does not cover listening devices, which can be pricey. Numerous Medicare Advantage plans provide hearing protection that consists of testing and clinically required listening device. Medicare Advantage intends give you alternatives for preserving a healthy and balanced way of living.Insurance that is purchased by a specific for single-person coverage or protection of a family members. The private pays the costs, instead of employer-based health insurance coverage where the company often pays a share of the costs. People may purchase as well as purchase insurance coverage from any type of strategies offered in the person's geographic area.

People as well as family members may get economic help to lower the price of insurance policy premiums and also out-of-pocket expenses, however only when enlisting through Attach for Wellness Colorado. If you experience certain modifications in your life,, you are eligible for a 60-day time period where you can register in a specific plan, also if it is outside of the yearly open registration period of Nov.

15. Attach for Wellness Colorado has a full listing of these Qualifying Life Occasions. Dependent kids that are under age 26 are eligible to be consisted of as relative under a moms and dad's coverage.

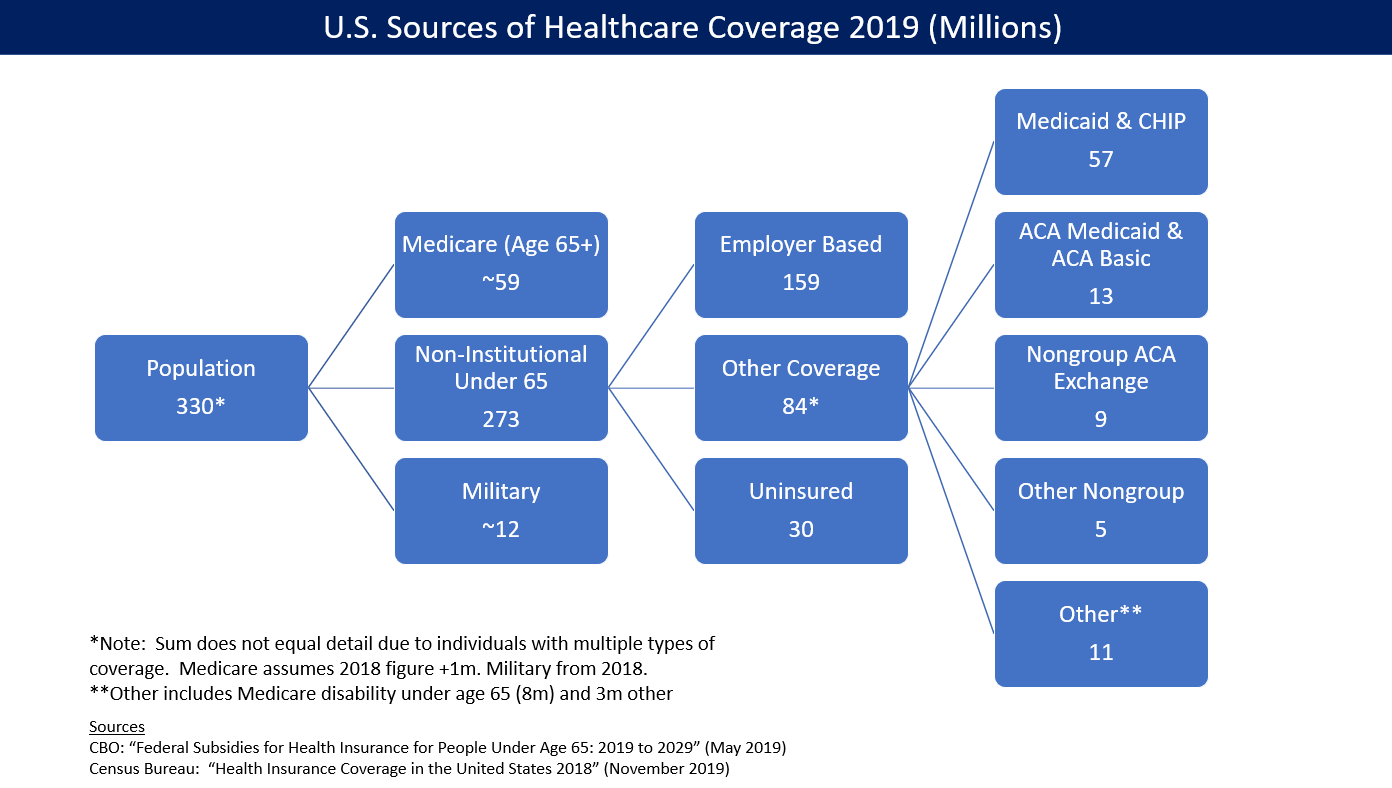

There are plenty of medical insurance options on the market, including both government-funded and also private alternatives. Anyone age 65 or older qualifies for Medicare, which is a federal program that uses budget-friendly health care coverage. Some individuals might choose to contrast this insurance coverage with exclusive insurance options. There are some significant differences in between Medicare as well as private insurance policy plan choices, insurance coverage, prices, and extra.

Medicare Advantage (Component C), Part D, as well as Medigap are all optional Medicare plans that are sold by private insurer. Medicare Advantage strategies are a popular option for Medicare beneficiaries because they supply all-in-one Medicare coverage - paul b insurance medigap. This includes initial Medicare, and also a lot of plans likewise cover prescription medicines, oral, vision, listening to, as well as other wellness rewards.

The differences in between Medicare as well as personal insurance are a significant consider deciding what sort of plan might work best for you. When you register in Medicare, there are 2 almosts all that compose your insurance coverage: There are numerous alternatives for acquiring private insurance coverage. Several individuals acquisition private insurance with their employer, and also their employer pays a part of the premiums for this insurance policy as an advantage.

The Best Strategy To Use For Paul B Insurance Medigap

There are four tiers of personal insurance policy plans within the insurance policy exchange markets. Bronze strategies have the highest insurance deductible of all the plans but the least expensive regular monthly premium.:max_bytes(150000):strip_icc()/universal-health-care-4156211_final-5737902ad86c462e930875d1c0878130.png)

Gold plans have a much reduced insurance deductible than bronze or silver strategies however with a high month-to-month premium. Platinum strategies have the most affordable insurance deductible, so your insurance policy often pays out extremely promptly, however they have the highest possible month-to-month costs.

Furthermore, some personal insurance provider additionally sell Medicare in the forms of go to the website Medicare Advantage, Component D, and also Medigap strategies. The insurance coverage you obtain when you register for Medicare depends on what kind of strategy you pick. Lots of people pick one of two alternatives to cover all their health care requires: original Medicare with Component D and Medigap.

If you require additional coverage under your plan, you must choose one that uses all-in-one protection or add extra insurance coverage strategies. You may have a strategy that covers your medical care solutions but needs additional plans for dental, vision, as well as life insurance advantages. Nearly all health insurance policy plans, personal or otherwise, have prices such a costs, insurance deductible, copayments, and coinsurance.

How Paul B Insurance Medigap can Save You Time, Stress, and Money.

There are a variety of costs connected with Medicare insurance coverage, depending on what kind of plan you select. Here is a look at the prices you'll see with Medicare in 2021: The majority of people are eligible for premium-free Component An insurance coverage. If you have not worked an overall of 40 quarters (10 years) throughout your life, the monthly costs arrays from $259 to $471.The everyday check these guys out coinsurance costs for inpatient treatment variety from $185. 50 to $742. The monthly costs for Part B starts at $148. 50, and can be more based on your revenue. The insurance deductible is $203 for the year. Coinsurance is 20 percent of the Medicare-approved price for services after the deductible has been paid.

These quantities differ based upon the plan you pick. Along with paying for parts An and B, Component D expenses vary relying on what kind of drug coverage you need, which drugs you're taking, and what your premium as well as insurance deductible amounts include. The regular monthly and annual cost for Medigap will certainly rely on what sort of plan you choose.

One of the most a Medicare Advantage strategy can butt in out-of-pocket prices is $7,550 in 2021. paul pop over here b insurance medigap. Nevertheless, original Medicare (parts An and also B) does not have an out-of-pocket max, meaning that your clinical prices can swiftly build up. Below is an introduction of a few of the common insurance coverage prices and exactly how they deal with regard to exclusive insurance: A costs is the regular monthly cost of your medical insurance strategy.

Excitement About Paul B Insurance Medigap

Coinsurance is a percentage of the overall accepted price of a service that you are accountable for paying after you have actually met your insurance deductible. Every one of these expenses depend upon the sort of private insurance strategy you select. Take stock of your monetary situation to identify what sort of monthly and yearly payments you can afford.

Report this wiki page